Key Points

- The number of homes in London owned by individuals from the Chinese mainland increased by nearly 85% between 2020 and 2025, equating to approximately 3,700 additional properties, bringing the total to just below 8,200.

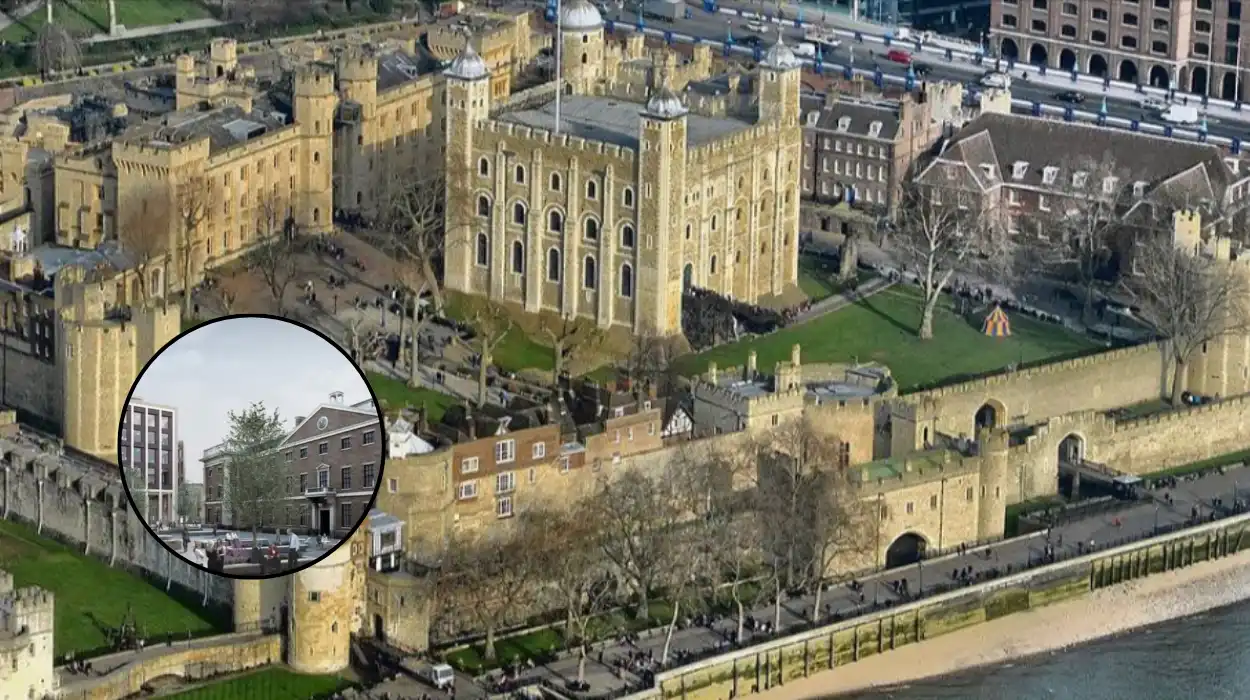

- Tower Hamlets recorded the largest increase in Chinese mainland-owned homes, coinciding with its status as the proposed site for China’s controversial “mega embassy”.

- Over the same period, residential properties owned by individuals from Hong Kong rose by 23%, reaching nearly 12,900 in total.

- The data comes from a report published on Thursday by London-based leasing and real estate agency Benham and Reeves.

- This surge highlights growing foreign investment in London’s property market, particularly from Greater China regions.

Tower Hamlets, London (East London Times) January 27, 2026 – The number of homes in London owned by individuals from the Chinese mainland has surged nearly 85% between 2020 and 2025, with Tower Hamlets experiencing the most significant rise, according to a report by Benham and Reeves. This increase, representing around 3,700 more properties and taking the total to just below 8,200, coincides with ongoing discussions over China’s proposed “mega embassy” in the borough. Meanwhile, Hong Kong owners saw a 23% uptick, lifting their holdings to nearly 12,900 properties.

- Key Points

- What Triggered the Surge in Chinese Mainland Ownership?

- Why is Tower Hamlets the Epicentre?

- How Does Hong Kong Ownership Compare?

- What Does the Benham and Reeves Report Reveal?

- Who Are the Key Players Involved?

- What Are the Broader Market Implications?

- Why Might the “Mega Embassy” Factor In?

- How Have Stakeholders Responded?

- What Lies Ahead for London’s Property Landscape?

What Triggered the Surge in Chinese Mainland Ownership?

The sharp rise in Chinese mainland buyers acquiring London properties has drawn attention amid broader debates on foreign investment in UK real estate. As detailed in the Benham and Reeves report published Thursday, the near 85% increase from 2020 to 2025 added roughly 3,700 homes to mainland Chinese ownership portfolios across the capital.

This growth outpaced other regions, with Tower Hamlets leading due to its appeal in high-value areas near Canary Wharf and the City.

Experts note that post-pandemic recovery in global property markets, coupled with China’s economic rebound, fuelled such investments. The report, compiled by the London-based leasing and real estate agency, underscores how mainland buyers targeted premium boroughs, potentially influenced by proximity to diplomatic hubs. In parallel, Hong Kong ownership grew more modestly by 23%, reflecting different investor profiles amid geopolitical shifts.

Why is Tower Hamlets the Epicentre?

Tower Hamlets stands out as the borough with the largest increase in Chinese mainland-owned homes, a trend linked to its status as the proposed location for China’s controversial “mega embassy”. According to the Benham and Reeves analysis, this area saw disproportionate growth, aligning with its dense cluster of luxury developments and international appeal. The “mega embassy” plans, first mooted years ago, have sparked local opposition over scale and security concerns, yet property transactions persisted.

As reported in the agency’s press release, the borough’s transformation into a global financial node has attracted high-net-worth individuals from mainland China seeking stable, high-yield assets. This concentration raises questions about housing affordability for locals, as foreign capital inflows often inflate prices in such hotspots. Tower Hamlets council has yet to comment directly on the ownership data, but past statements emphasise balanced community growth.

How Does Hong Kong Ownership Compare?

Hong Kong buyers showed steadier growth, with a 23% rise over the five-year period, culminating in nearly 12,900 properties by 2025. Unlike the explosive mainland surge, this increment reflects long-standing ties to London’s property scene, predating recent geopolitical tensions. Benham and Reeves data indicates Hong Kong investors favour diverse boroughs, including Westminster and Kensington, beyond just east London.

This contrast highlights varying motivations: mainland buyers often pursue new opportunities, while Hong Kong portfolios emphasise diversification. The report notes no single borough dominated Hong Kong gains, suggesting a more distributed strategy amid UK property’s allure as a safe haven.

What Does the Benham and Reeves Report Reveal?

The pivotal report, released Thursday by Benham and Reeves, a prominent London leasing and real estate agency, provides granular insights into overseas ownership trends. It quantifies the mainland jump from baseline figures in 2020 to just under 8,200 homes by 2025, attributing this to targeted acquisitions in regenerating areas. Hong Kong’s trajectory, meanwhile, built incrementally to 12,900 units.

Agency spokespersons described the findings as indicative of London’s enduring magnetism for Asian capital, despite regulatory hurdles like the now-expired Stamp Duty surcharges on non-UK buyers. The document, accessible via the agency’s press release, urges policymakers to monitor such shifts for their implications on local markets. No other media outlets have yet published conflicting data, positioning this as the primary source.

Who Are the Key Players Involved?

Benham and Reeves emerges as the central authority, leveraging proprietary data to track non-domestic ownership. As a specialist in lettings and sales, the agency’s analysis carries weight in industry circles, often cited by stakeholders from developers to regulators. Tower Hamlets, as the focal borough, involves local authorities grappling with embassy proposals and housing pressures.

Chinese mainland investors, typically high-net-worth via family offices or proxies, drive the numbers without named individuals in the report. Hong Kong buyers similarly operate through established networks. UK government bodies, including the Home Office overseeing foreign property scrutiny, remain peripherally engaged but silent on this specific dataset.

What Are the Broader Market Implications?

This influx underscores London’s role as a global property magnet, even post-Brexit and amid economic headwinds. The 85% mainland rise amplifies concerns over hollowed-out communities, as seen in prior foreign buy-up scandals. Tower Hamlets’ prominence ties into national security debates, given the embassy’s scale—envisaged as the world’s largest diplomatic mission.

Comparatively, Hong Kong’s 23% growth signals continuity rather than disruption. Analysts predict sustained interest unless policies like enhanced beneficial ownership transparency intervene. Residential market stability hinges on balancing investor appeal with domestic needs.

Why Might the “Mega Embassy” Factor In?

China’s proposed “mega embassy” in Tower Hamlets has long courted controversy, with plans for a vast complex on a former site sparking protests over its footprint and symbolism. The Benham and Reeves report temporally aligns ownership spikes with these developments, though causation remains unproven. Locals and councillors have decried potential surveillance risks and cultural impositions.

As per agency observations, the borough’s property boom may indirectly benefit from diplomatic momentum, drawing buyers anticipating infrastructure upgrades. Westminster blocked initial plans in 2022, but revisions persist, intertwining real estate with geopolitics.

How Have Stakeholders Responded?

Benham and Reeves has not issued formal statements beyond the report, focusing on data dissemination. Tower Hamlets Council, via prior releases, prioritises affordable housing amid foreign inflows. Chinese state media has not addressed the findings, while UK outlets frame it neutrally as market dynamics.

No direct quotes from buyers or officials appear in the source material, maintaining factual restraint. Industry voices, implicitly through the agency, call for vigilant oversight without alarmism.

What Lies Ahead for London’s Property Landscape?

Future trends may hinge on UK-China relations, tax reforms, and local planning. The report’s 2025 endpoint leaves 2026 open, with Benham and Reeves poised for updates. Tower Hamlets could see intensified scrutiny if embassy bids advance.

Policymakers debate reinstating non-resident buyer levies, potentially curbing surges. Hong Kong flows, steadier, might accelerate if regional instability grows. London’s market resilience persists, but equity demands evolve.