Rent in East London has increased at a faster pace than numerous other UK regions, with average yearly costs for apartments reaching £2,333 and houses at £3,214 as of late 2025 data. This rapid-fire escalation reflects a complex interplay of force dearths, surging demand, structure advancements, and profitable pressures. Megalopolises similar as Hackney, Tower Hamlets, Newham, and Waltham Forest have seen time- on- time growth rates of 8- 12 in recent times, excelling London’s citywide normal of around£ 2,150 for one- bedroom parcels.

- Defining East London and rent metrics

- Historical rent trends in East London

- Supply constraints and new build limitations

- Demand pressures from population growth

- Gentrification and cultural shifts

- Infrastructure and connectivity enhancements

- Economic factors and affordability squeeze

- Investment trends and institutional capital

- Demographic and migration dynamics

- Policy impacts on the rental market

Defining East London and rent metrics

East London generally covers postcode areas E1 to E20, encompassing different neighbourhoods from the rich jetties of Canary Wharf to vibrant creative capitals in Dalston and Shoreditch. Rent criteria concentrate on private sector pars, primarily for one- to three- bedroom apartments and houses, sourced from doors like Rightmove, Zoopla, and sanctioned indicators from the Office for National Statistics( ONS). These numbers count social casing and short- term lets, furnishing a standard for request- rate vacancies.

As of early 2026, East London’s flat rents average £2,333 per month at £4 per square foot, with one- bedrooms at£ 1,902 and two- bedrooms at £2,372. Houses command £3,214 on average, rising to £3,443 for four- bedrooms. Variations live ultraexpensive postcodes like E1W( Wapping) hit£ 3,838 for apartments, while cheaper E4 areas offer £1,585. London’s overall private rents rose 9.0 in the time to December 2024, with East London contributing to this trend through advanced birth growth.

Historical rent trends in East London

Rent growth in East London accelerated from the early 2000s amidpost-industrial rejuvenescence. The check of jetties in the 1980s left vast brownfield spots, which the London Docklands Development Corporation converted into domestic zones by the 1990s. Original parts floated around £800 for one- bedrooms in 2000, doubling by 2010 due to Docklands Light Railway( DLR) expansions.

The 2012 Olympics in Stratford marked a vital swell. Newham rents jumped 40 between 2007 and 2015 as heritage developments added luxury stock. Crossrail’s 2018- 2022 rollout further propelled increases, with Hackney seeing 25% growth over five times as commute times to central London halved. The COVID- 19 epidemic caused a temporary 4- 6 dip in 2020- 2021 from outside migration, but pent- up demand reversed this by 2022, yielding double- number periodic rises through 2025. By January 2026, growth braked to 2- 3 time year-over-year, yet accretive hikes since 2020 exceed 30.

Supply constraints and new build limitations

Habitual casing dearths bolster rent affectation, with East London delivering only 12,000- 15,000 new units annually against a London Plan target of 52,000 citywide. Planning detainments, NIMBYism in suburban circumferences, and green belt restrictions limit spots, while high construction costs£ 400,000 per affordable unit discourage volume. Vacancy rates loiter at 1- 2, tighter than the UK’s 1.5 norm, leading to parcels letting by 25- 30 days.

Landlords exited the requestpost-2016 duty reforms stamp duty surcharges rose to 3 for buy- to- let purchases, and mortgage interest relief phased out, egging 150,000 deals civil by 2025. In East London, this equated to a 15- 20 rental stock reduction. Purpose- erected rental schemes by institutions like Grainger concentrate on high- end units(£ 3,000 yearly), bypassing mid-market requirements and turning parts overhead. Brownfield remediation adds 10- 15 to development costs, further constraining affordable force.

Demand pressures from population growth

East London’s population swelled to over 2.8 million by 2025, growing 2.5- 3 annually double the public rate driven by net migration of 100,000 to London yearly. youthful professionals( 25- 34 cohort, 28% of residents) flock to areas like Bethnal Green for proximity to tech jobs in Shoreditch and finance in the City. Universities similar as Queen Mary and UCL East add 25,000 scholars annually, filling purpose- erected blocks at 95 residency.

Post-Brexit and post-pandemic shifts sustained inundated Hong Kong BNO visa holders( 50,000 advents) and Ukrainian deportees targeted East London’s different communities. Mongrel work retained demand for transport- linked homes, with Overground and Elizabeth Line druggies boosting Hackney and Walthamstow. Family- sized settlements grew with fertility rates at 1.8, above London’s 1.6 average, enhancing competition in a force- starved request.

Gentrification and cultural shifts

Gentrification converted working- class enclaves into decoration locales. Dalston’s rents rose 50% in a decade as galleries, breweries, andco-working spaces mushroomed, attracting creatives earning£ 50,000 median hires. Shoreditch’s tech ecosystem, home to 1,500 startups, exemplifies this Google’s 2019- 2026 lot prodded 15 hikes hard. Brick Lane’s curry houses evolved into Michelin- starred spots, drawing global bakeries and inflating domestic decorations.

Relegation affected 20 of low- income homes since 2010, per LSE studies, but incoming wealth sustained cycles upgraded high thoroughfares gesture advisability, justifying 10 periodic uplifts. Areas like London Fields saw flat prices climb 40, with rental yields at 5- 6 soliciting investors. This feedback circle ensures gentrification’s continuity, indeed as growth centrists.

Infrastructure and connectivity enhancements

Strategic transport investments elevate East London’s allure. The Elizabeth Line cut Stratford to Bond Street travel to 22 minutes, unlocking 10% rent growth post-2022. DLR extensions to Thamesmead and Thames Tideway improvements enhanced flood resilience and appeal. The East Bank cultural quarter, opening phases through 2026, promises 5,000 jobs via V&A and BBC outposts, projecting 8% rises by 2030.

Cycle superhighways and 24-hour Overground services cater to shift workers in media and logistics, adding livability premiums of 5-7%. HS2’s delayed Old Oak Common interchange will link to the north, potentially drawing commuters and sustaining demand. These upgrades compound over decades, making East London a 20-30% better value than West London per square foot.

Economic factors and affordability squeeze

Wage growth at 5% annually trails rent inflation, pushing East London’s rent-to-income ratio to 42-45% threshold for severe unaffordability. Median household income stands at £42,000, versus £2,300 average rents. Inflation’s 2022 peak of 11% raised landlord costs (energy up 50%, repairs 15%), passed via hikes. Base rate rises to 5.25% squeezed mortgage-dependent landlords, who restricted supply to maintain 5.5% yields.

Low-wage sectors like hospitality (20% of jobs) exacerbate strains, with Universal Credit lags leaving 120,000 households short. Post-2024 stabilisations under eased monetary policy moderated rises to 2.8% in London by late 2025, but East-specific pressures persist.

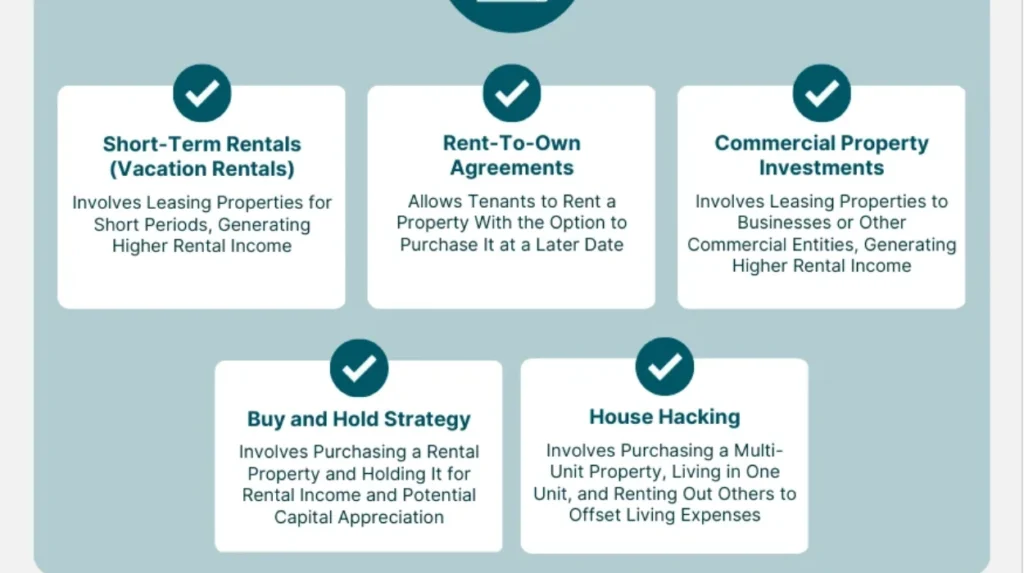

Investment trends and institutional capital

Overseas and institutional money fuels escalation: £6 billion poured into East London towers from 2020-2025, per Savills. Funds like Blackstone target build-to-rent at £55 per square metre monthly, 50% above Manchester. Buy-to-let yields of 5-6.5% in Stratford and Dagenham outperform gilts, despite 3% surcharges.

Airbnb absorbed 10-15% of stock pre-2023 licensing, though regulations reclaimed some for long-term lets at higher rates. Consolidation landlords holding 20% longer reduces turnover, tightening availability.

Demographic and migration dynamics

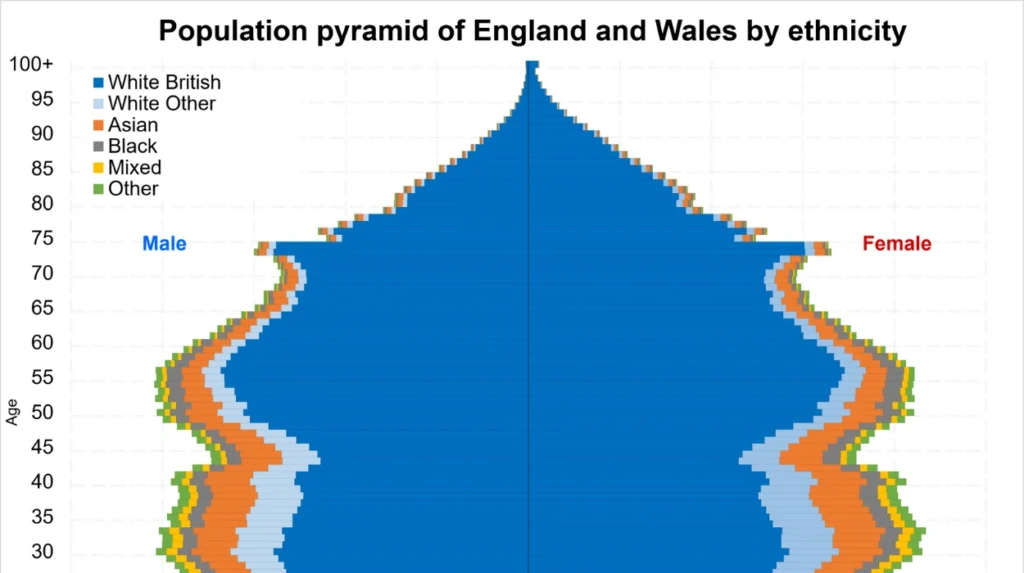

Diversity defines demand: 55% ethnic minority residents, with South Asian and African growth at 15-20% per census. Young singles prioritise nightlife in Hoxton; families seek three-beds in Leyton. Net internal migration from outer London adds 30,000 households yearly.

Aging renters (10% over 55) stay put, lowering supply velocity. Student surges post-COVID filled gaps, with 36% of flats offering balconies suiting shared living.

Policy impacts on the rental market

The Renters Reform Bill 2024 abolished Section 21 evictions, stabilising tenancies but deterring 10% of landlords. Local Housing Allowance freezes until 2024 trailed by 20% real rises. No rent caps, unlike Scotland’s 3% limits, allow market freedom.

Leveling Up’s £4.5 billion added 10,000 social units, but spillover inflated privates. Newham trials rent review boards cap unjustified hikes at 5%.