Paying your council tax online in Tower Hamlets is straightforward through the Tower Hamlets Council website. Residents can log into their My Council Tax account using their 10-digit account number or set up a new account to make secure payments via debit or credit card, Direct Debit, or online banking. This method ensures quick processing and helps local residents in East London stay compliant with their bills.

Why This Matters to Local Residents

Council tax funds essential services like waste collection, street cleaning, and community support across East London councils, including Tower Hamlets, Newham, Hackney, Waltham Forest, Redbridge, and Barking & Dagenham. For residents facing tight budgets, timely online payments prevent accrual of late fees or enforcement actions, safeguarding financial stability. In Tower Hamlets, where many households rely on local services, managing payments digitally reduces stress and supports smoother access to housing and welfare provisions.

Staying on top of council tax obligations helps East London council tenants and homeowners maintain good standing with authorities. Missed payments can lead to reminders and added costs, impacting families in areas like Newham council or Hackney who prioritise essential spending. Online payment options empower local residents to handle bills efficiently from home, aligning with busy lifestyles in these vibrant communities.

Which Council Service Handles It

Tower Hamlets Council manages all council tax accounts and online payments through its dedicated Revenue Services team. This service oversees billing, collections, and account management for properties in the borough. Residents from neighbouring East London councils, such as Newham council or Waltham Forest, follow similar processes via their own portals, but Tower Hamlets-specific payments must use the local system.

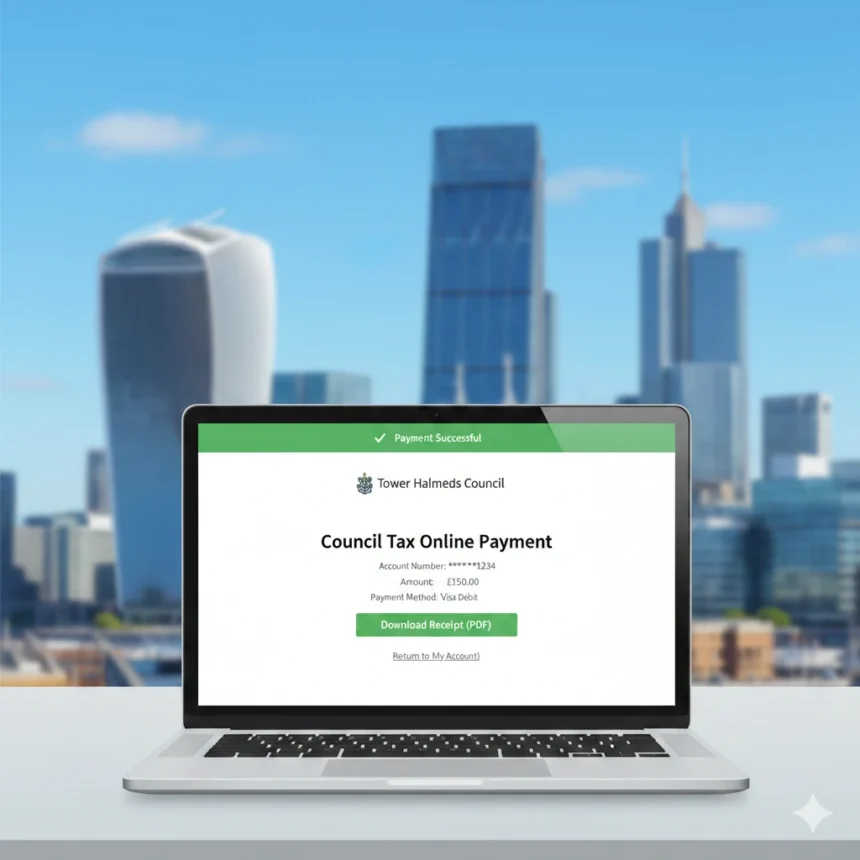

The My Council Tax online portal, accessible via the main council website, centralises these functions. It connects directly to the council’s secure payment gateway, ensuring transactions align with UK financial regulations. For Tower Hamlets council users, this service provides a single point for viewing balances and updating details.

Step-by-Step Actions to Solve the Problem

Follow these clear steps to pay your council tax online in Tower Hamlets:

- Locate your 10-digit Council Tax account number on your latest bill or reminder notice.

- Visit the Tower Hamlets Council website and navigate to the Council Tax section, then select “Manage my account” or “Pay online.”

- Register for a My Council Tax account if you lack one, using your account number, postcode, and email address; confirm via the emailed link.

- Log in with your User ID and password, then choose “Make a payment” or “Set up Direct Debit.”

- Enter your payment amount, select debit/credit card details (avoiding unsupported cards like American Express), and confirm the transaction.

- Save or print the on-screen confirmation, noting the unique transaction reference for records.

Payments via card process securely, with funds typically allocated the next working day. Opting for Direct Debit automates future instalments on dates like the 1st, 10th, 20th, or 26th of the month.

Information or Documents Needed

To pay online, have your Council Tax account number ready, found on bills issued annually from 1 April to 31 March. You’ll also need a valid debit or credit card, excluding types like Solo or Diners Club. For Direct Debit setup, provide your bank sort code, account number, and full address matching the billing details.

No physical documents upload is required for standard payments, but keep your bill handy for reference. Tower Hamlets council verifies identity through the account number and registered details, ensuring security. East London residents in Redbridge or Barking & Dagenham preparing similar payments should gather equivalent info from their local council bills.

Expected Response Time

Online card payments in Tower Hamlets reflect in your account the next working day if made before typical cut-off times, such as 4:45pm weekdays. Direct Debits or online banking transfers may take 2-3 working days to clear and allocate. Confirmation emails arrive immediately post-transaction, with full account updates visible upon login shortly after.

For urgent payments, card options provide the fastest visibility, helping local residents confirm compliance quickly. Delays over weekends or bank holidays extend processing, so plan ahead during peak bill cycles. Tower Hamlets council processes high volumes efficiently, minimising wait times for East London council users.

What to Do If Follow-Up Is Required

If a payment does not appear within expected times, log back into your My Council Tax account to check the balance first. Contact Tower Hamlets Council’s Revenue Services via the designated enquiry option in your online account if discrepancies persist. Provide your account number, payment reference, and date for swift resolution.

Keep records of all confirmations to support queries. For East London residents in Hackney or Newham council facing similar issues, their portals offer comparable follow-up tools. Persistent problems may require verifying bank details or resubmitting payments to avoid escalation.

Rights and Responsibilities Under UK Rules

Under the Local Government Finance Act 1992, Tower Hamlets residents must pay council tax as billed, with instalments spread over 10 or 12 months. Taxpayers hold the right to clear billing statements, payment receipts, and dispute resolutions via formal council processes. Councils like Tower Hamlets must offer reasonable payment methods and notify of changes, upholding transparency.

Residents can request refunds for overpayments directly through their online account. Failure to pay triggers statutory reminders, court summons, or enforcement, but early contact allows arrangements like instalment plans. East London council taxpayers in Waltham Forest or Redbridge share these balanced obligations, promoting fair local funding.

Practical Tips to Avoid the Problem in Future

Switch to Direct Debit for automatic payments, eliminating manual errors and ensuring adjustments for bill changes. Using bank details—sort code 60-03-19, account 75666995—secures seamless monthly deductions on chosen dates. Regularly check your My Council Tax account for balances and paperless billing to catch issues early.

Update contact details promptly to receive e-bills, reducing postal delays for Tower Hamlets council users. East London residents in Newham council or Barking & Dagenham benefit from similar logins, fostering proactive management. Budget annually around the April bill, allocating for services supporting community welfare.

Set calendar reminders for payment dates, especially during tax year starts. Opt for online banking with the council’s reference to bypass card fees long-term. These habits keep local residents ahead, supporting stable finances amid East London living costs.

Mastering online council tax payments in Tower Hamlets equips residents with control over essentials. By leveraging the My Council Tax portal, individuals in Tower Hamlets, alongside peers in Hackney or Redbridge, ensure compliance effortlessly. This approach not only simplifies administration but reinforces community resilience through reliable local services.